Property Taxes Reimagined

Alberta’s local governments are increasingly under pressure to reduce their property taxes. There are many things affecting municipal budgets and your council’s ability to pay for the services, equipment, and infrastructure to have a thriving community.

Inflation, cutbacks in provincial funding, and downloaded costs from higher levels of government are all combining to create a snowballing burden on your local government.

Alberta Municipalities, as the voice of summer villages, villages, towns, cities, and specialized municipalities in which 85% of Albertans live, has conducted extensive research into the challenges facing communities across the province. Our research looks at trends and issues affecting all municipal governments (both urban centres and rural counties) and our analysis raises questions about how Alberta's approach to property taxes might be reimagined to enable our communities to be sustainable as they grow.

We encourage you to click on and review the sections below and engage with the supporting information to become fully informed on the challenges facing Alberta’s municipal governments.

Click the blue boxes to access detailed research.

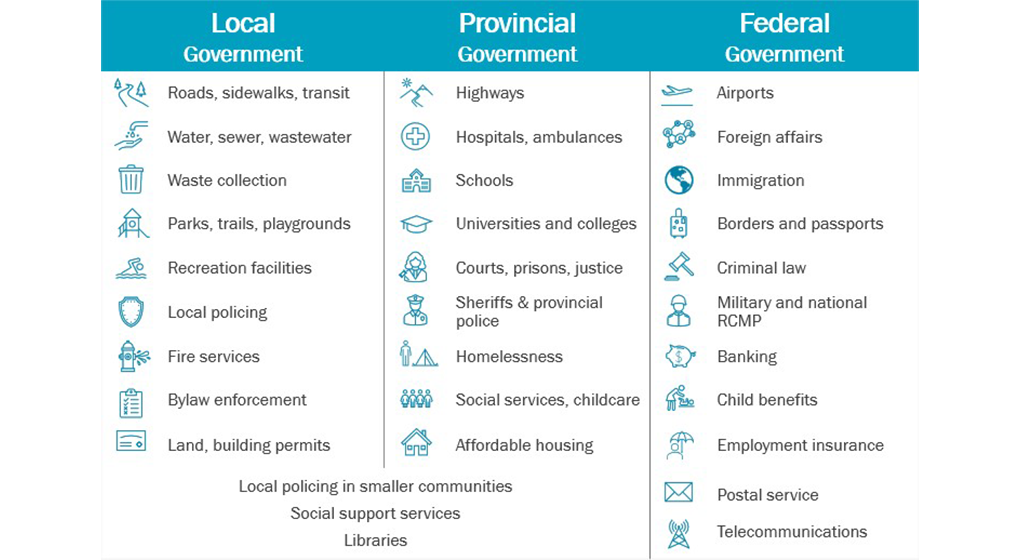

In Canada, there are three levels of government:

- Local government or municipal government

- Provincial government

- Federal government

Each level of government has its own means of raising the money it needs to pay for the services for residents.

For example, the Government of Canada uses income taxes, GST, and other taxes to raise the money it needs to provide the many services Canadians need to build a strong and safe national society. The federal government can go into as much debt as it needs to pay for services. They can also plan for a budget deficit, that is, it can spend more than it earns in a year.

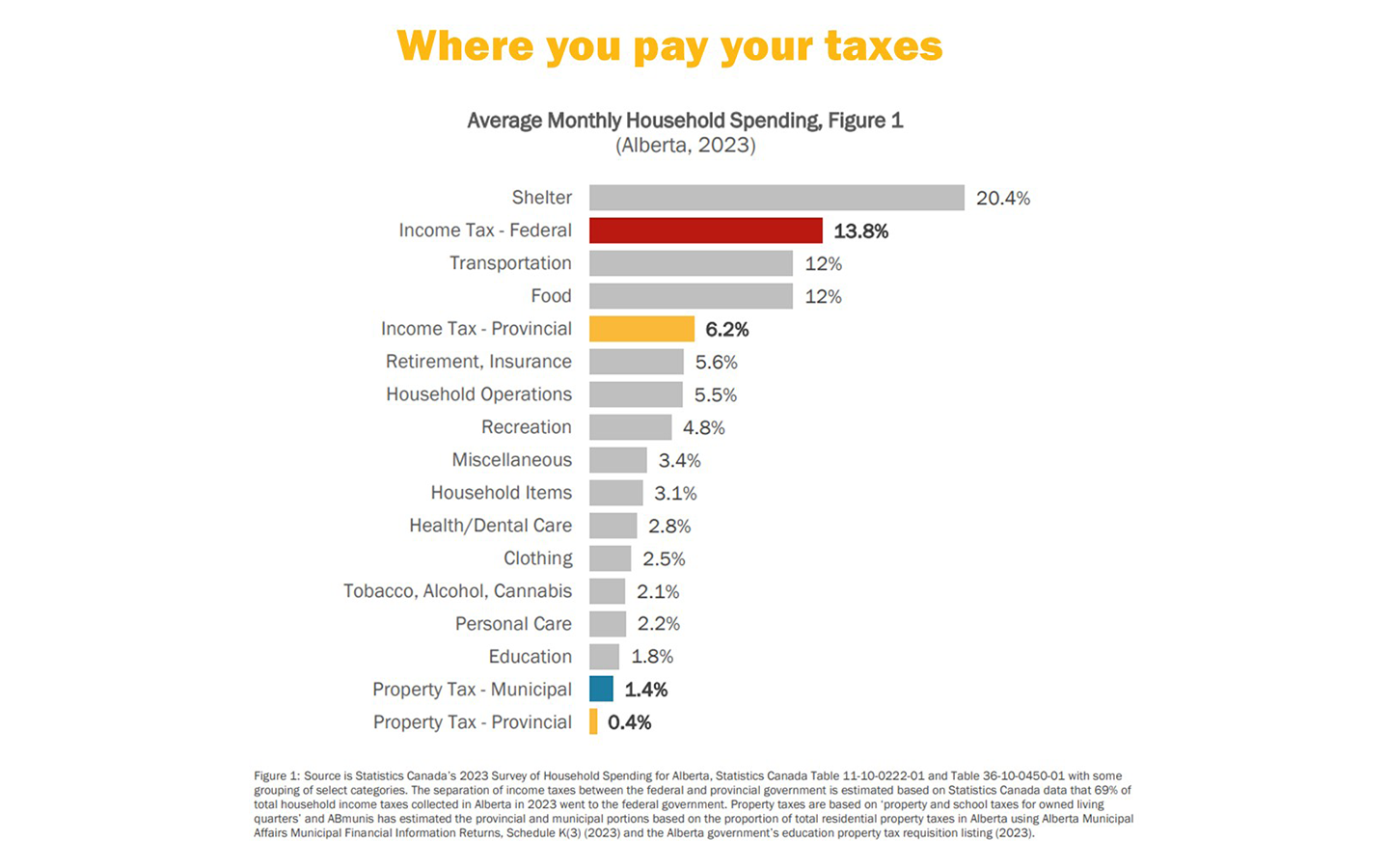

DID YOU KNOW? …on average, Albertans pay about 13.8% of their household spending on federal income taxes, 6.6% on provincial income and property taxes, and 1.4% on municipal property taxes.

The Government of Alberta uses income taxes, property taxes, royalties on oil and gas, and other taxes to raise the funds it needs to pay for services like healthcare, education, and social supports. Like the federal government, the Alberta government can create new taxes, go into as much debt as it can afford, and can plan for a budget deficit.

Find out more about the taxes paid by an average Alberta household in comparison to other costs.

Local municipal governments are different from the federal and provincial governments because they can generally only collect money through:

- Property taxes

- Fees for services to homes and businesses, like water, garbage pickup, and recycling

- User fees, like paying to use the swimming pool, arena, or to join a program

Provincial laws also restrict municipal governments so they:

- Can’t create new taxes

- Can’t borrow money beyond a set limit

- Have to pass a balanced budget

Because of these provincial laws, municipal tax rates must always be set high enough to cover all their costs for the year.

Learn more about the tough choices municipalities make to balance their budgets.

Each level of government is responsible for different public services but there is overlap in some services.

For example, the Government of Canada provides transfers to the province for health services and key infrastructure and both the federal and provincial governments will provide transfers to municipalities for community infrastructure and some programs.

Municipal property taxes are the main tool that municipalities have to raise the money they need to pay for local public services used by residents. While you pay income taxes based on how much money you make in a year, property taxes are based on how much your home or land is worth. The system is based on the same principle: if someone owns a more valuable home or land, it is assumed they can afford to pay more in property taxes.

Municipal governments use a mix of municipal property taxes and user fees to collect money to pay for local services. You pay a user fee for services like having clean water piped to your home and wastewater, garbage and recycling taken away, or a fee to use the swimming pool, arena, or other program.

Each council can decide what rate they set for their municipal property taxes or user fees as long as they balance their budget.

When comparing your property taxes with another community, you should also consider if the other community has:

- higher or lower user fees

- different types of services or quality of services

- more or fewer businesses that help share the cost of local services

Often, the money from municipal property taxes and fees are not enough for a municipality to save up for the high cost to repave roads, replace old water pipes, or update recreation centres. If your community is growing, its needs even more money to expand roads and sewage treatment systems or add a fire hall, library, or recreation centre.

Learn about the challenges faced by one of Alberta’s towns when property taxes can’t keep up with community needs. Read their story here.

But municipal governments can’t create new taxes and are restricted in how much money they can borrow, so they often need to ask the provincial or federal government to help pay some of the costs for local services. The funds provided by the higher levels of government are often called ‘grants’ or ‘transfers’.

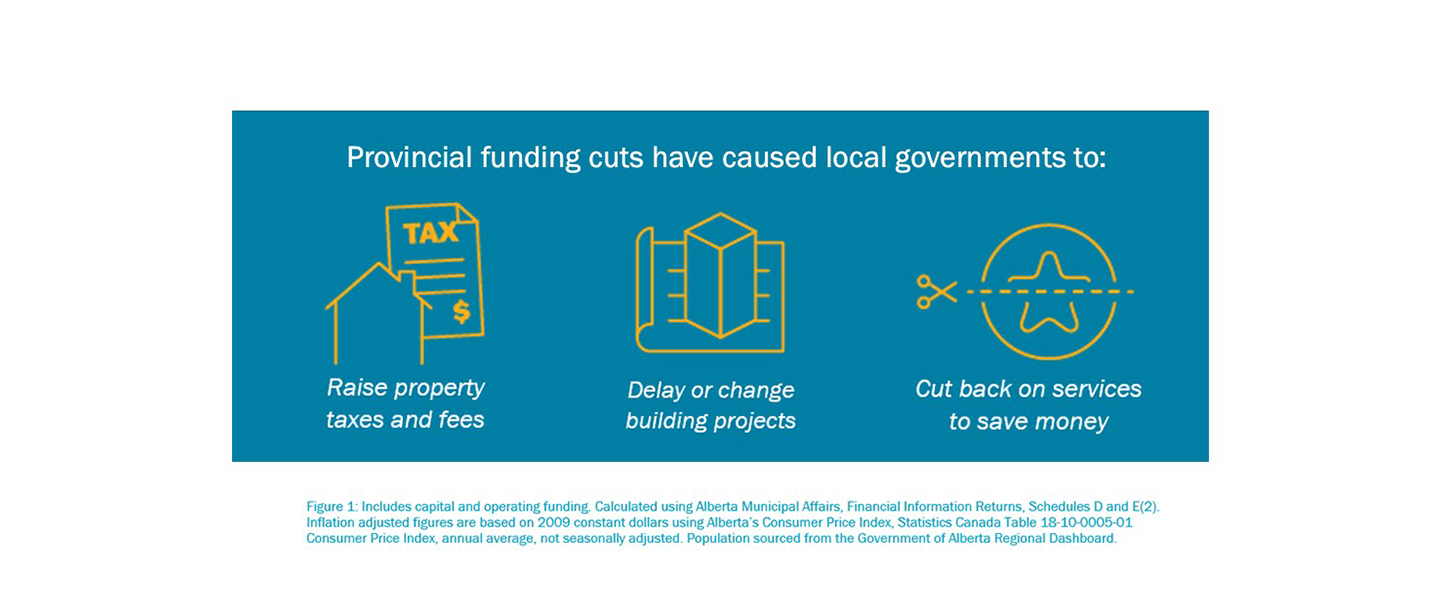

When transfers are not available or not enough, municipalities must make hard decisions about what services they are able to provide to their residents. Over the last 15 years, the Alberta government has cut the money it gives to municipal governments by half.

Ask any mayor or councillor and they will tell you that rising costs is one of their biggest challenges in serving their community. Many factors have combined to drive up costs for municipalities:

- Inflation on the things municipalities need to buy

- Decisions by other levels of government

- New needs of a community

- Inflation

While Albertans have seen the effects of inflation on their household budgets, municipal governments have also seen their costs go up. But, instead of buying weekly groceries, your municipal government needs to:

- Buy equipment, trucks, pipes, concrete, and road materials

- Cover energy costs to heat and cool buildings and keep streetlights on

- Pay local contractors, workers, & employees

Some of these costs have skyrocketed for municipalities in recent years. For example:

- A fire truck now costs over $1 million more than it did in 2020, that’s a 73 per cent increase

- RCMP wages went up by 24 per cent between 2017 and 2022

- Construction costs are so expensive that councils are delaying repaving roads or they are changing their plans to replace community buildings, like libraries and recreation centres.

Learn more about how inflation is increasing your property taxes.

Video: Inflation Affects Local Government Budgets & Your Property Taxes

- Decisions by Other Levels of Government

In 2024, the Alberta government changed election rules which makes it more expensive to hold local elections and in 2020, the Alberta government started charging small communities for part of their RCMP costs.

As scientists learn more about the environment, new rules have been made for how municipal governments must take care of clean water and sewage. These rules are good because they help protect people and nature. But sometimes, they mean municipalities have to spend a lot of money to upgrade their sewage lagoons or treatment systems.

Town of Drayton Valley - New Rules Create Big Costs

- New Community Needs

Our society is constantly changing, and councils need to respond to the needs of their residents. Despite stagnant funding from the Alberta government, municipal governments have seen the need to significantly increase their spending on Family and Community Support Services programs to help families in need.

The Alberta government is responsible for many services in communities, like healthcare and affordable housing. Sometimes residents expect a better quality of service and so some councils are choosing to spend money to recruit doctors to their community or build facilities or programs to help the homeless.

Alberta’s population has been growing at an incredible pace, and some cities and towns are now facing big costs like the need to expand high-traffic roads, and add new fire halls, libraries, and recreation centres to serve their growing population.

Alberta has a law that forbids your municipal government from planning to spend more money than it will raise in taxes and other revenue. So, when the costs for your municipal government go up, your council has only two choices:

- Spend less money, which might mean cutting services for your community, or

- Raise more money, usually by raising municipal property taxes or fees.

Video: Provincial Funding & Your Municipality's Budget

Rising Provincial Property Taxes

It might seem like property tax is only a local tax because your municipal government sends you the bill, but part of your property tax bill is a tax by the Alberta government. The provincial property tax is often called the education property tax because it helps to cover some of the Alberta government’s costs to run kindergarten to Grade 12 (K-12) schools.

Your municipal government and council has no control over the provincial property tax. In 2025, the Alberta government increased its tax on homes and property by 14 per cent. Another 10 per cent increase is planned for 2026. The increase is part of the Alberta government’s new plan for provincial property taxes to cover one-third of the cost to run Alberta’s K-12 schools.

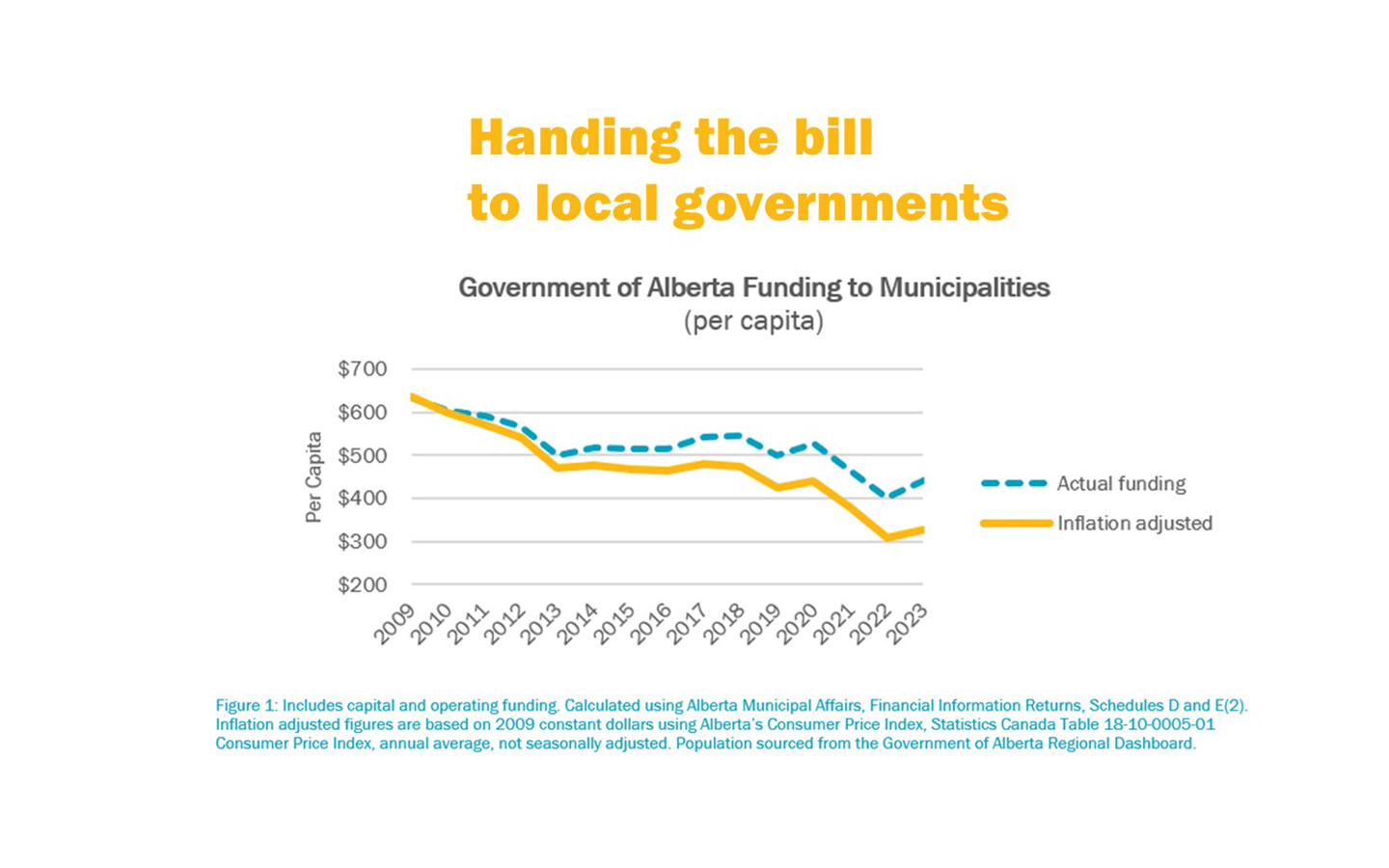

Cuts in Provincial Funding

Another reason your property taxes are increasing is that over the last 15 years, the Alberta government has cut by half the money it gives to municipal governments. In 2009, municipalities got about $635 per person from the Alberta government. By 2023, that amount went down to $327 per person after adjusting for inflation.

You can learn more about the provincial government's cuts to funding for local governments.

New Costs and Inflation

As we mentioned in the section above, on top of all this, municipal councils are managing:

- Higher costs due to decisions by the federal and provincial governments (e.g. policing and environmental requirements)

- The province’s restriction of certain revenue tools (photo radar and traffic fine sharing - the province takes almost half of all traffic fine revenues) which previously helped pay for policing

- Expectations from residents to supplement provincial services (e.g. doctor recruitment, affordable housing, and social services) to improve the quality of life in their community.

The reality is every municipal government has to balance their budget, so when a municipality gets less money from the provincial or federal government or has to take on new costs AND deal with inflation, your council has two choices:

- Cut back on services like fixing roads or running programs, or

- Find money somewhere else, usually by raising municipal property taxes.

Learn more about the tough choices municipalities make to balance their budgets.

Video: Cumulative Effects Impacting Municipal Budgets

Your property taxes have likely been going up for years and they will probably keep going up. Why? Because of all the reasons we’ve explained in the sections above.

The reasons for your property tax increases include:

- rising provincial property tax,

- less money from the Alberta government for municipal governments,

- new responsibilities for municipal governments, and

- inflation driving up costs.

Video: Municipal budget restrictions, cost savings, & your property taxes

If you rent your home, you might not see the property tax bill, but you are still paying property tax through your monthly rent payment. If the property tax goes up, your landlord may feel the need to raise your rent.

As you think about your money and the future of your community, Albertans may want to ask:

- Should the Alberta government keep shifting more taxes onto property owners and renters?

- Should councils still be the ones collecting the province’s property tax?

- If things stay the same, what will your community look like in 10 to 20 years? Will your life be better or worse?

If you have ideas, contact your local MLA or your local council and share your thoughts on how we can reimagine property taxes to strengthen the future of Alberta’s communities.

Information Papers

- Stacking Up the Bills: The Snowballing Burden on Property Taxes

- Provincial Property Tax: The Misunderstood Tax

- Handing the Bill to Local Governments

- Inflation: The Hidden Cost Driving Up Property Taxes

- To Cut or Tax: The Fight to Balance the Budget

- Where You Pay Your Taxes

- Property Tax Bill Stuffer - Rising Provincial Property Tax